How To Set Up Scanner For Day Trading

4 Great Intraday Scans for Mean solar day Traders

The marketplace moves fast when you're 24-hour interval trading. If you don't spot a setup earlier it happens, it will be gone before you can open a position. That'south why having scans that you can use throughout the solar day to notice potential twenty-four hour period trades is so important.

With Scanz, yous can employ both the Breakouts module and the Pro Scanner to apace find stocks that are ripe for day trades. In this article, nosotros'll cover iv different intraday scans that twenty-four hour period traders can employ to identify promising stocks.

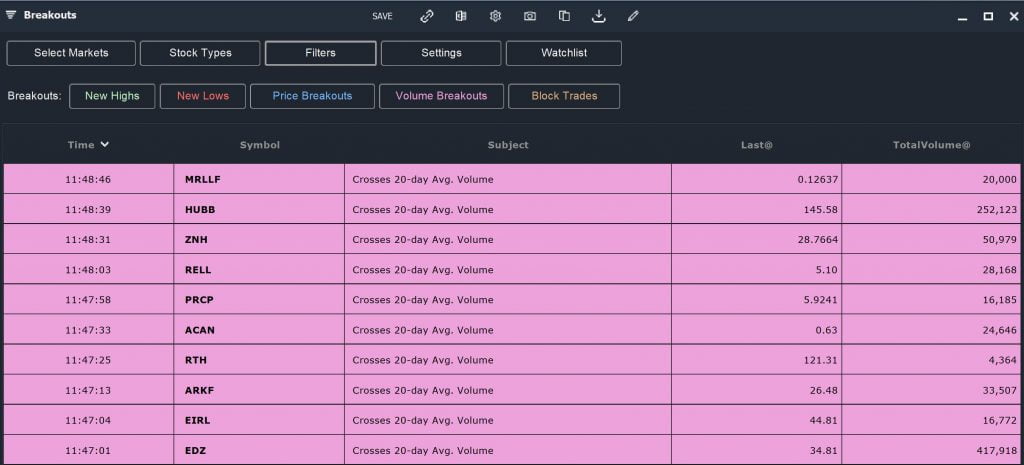

1. Finding Volume Breakouts

Volume is critical to any intraday stock scan. Stocks that are trading with higher than boilerplate volume are likely experiencing more price volatility, which opens upwards opportunities to plow a quick turn a profit. Importantly, more volume besides means more liquidity. So, yous can go into a day trade on a tight timeframe knowing that your orders are going to be fulfilled.

In that location are two ways to spot book breakouts in Scanz. The first is to use the Breakouts module. There, you can quickly filter for stocks that are trading above their ten- or twenty-solar day average daily book.

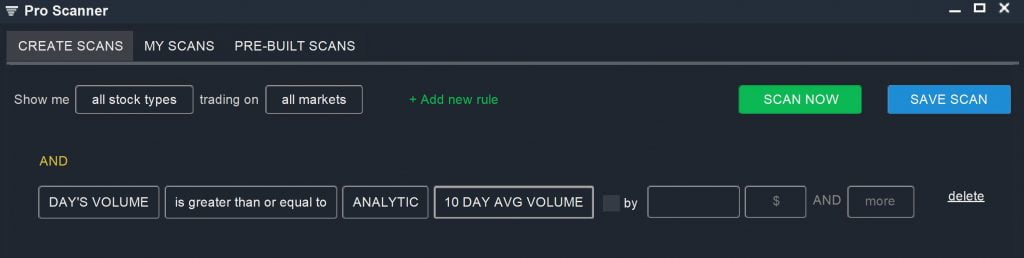

You can likewise use the Pro Scanner to find volume breakouts. The following parameter will yield the aforementioned results as the Breakouts module:

DAY'S Book is greater than or equal to ANALYTIC 10 Twenty-four hours AVG Book

Meliorate yet, you can apply the Pro Scanner to combine a volume filter with another intraday scan. This is perhaps the best approach to scanning for volume breakouts, since yous tin can search for stocks that have both high liquidity and another intraday entry bespeak.

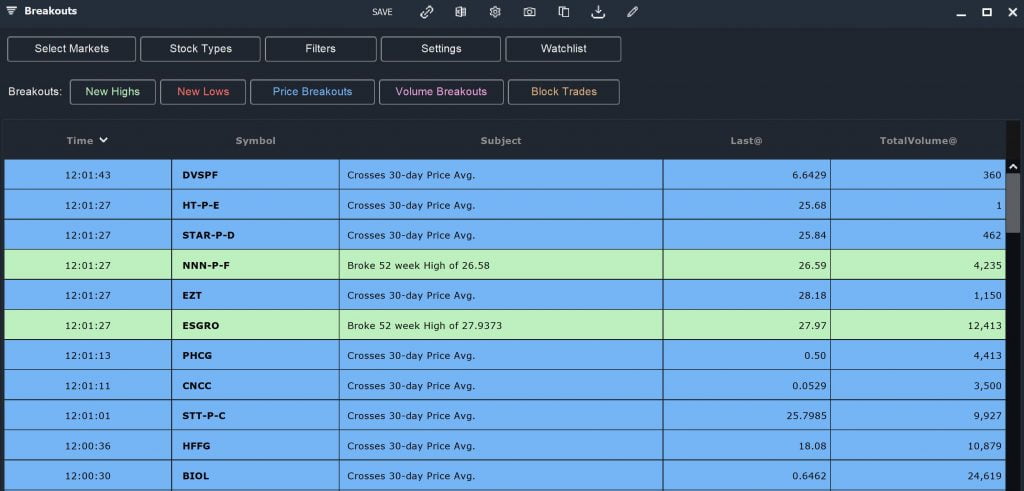

2. Spotting Intraday Price Breakouts

Scanning for price breakouts is besides an effective way to find stocks for intraday trading. Toll breakouts – whether to a higher place a 52-week high or below a long-term moving average – can signal the kickoff of a broader trend or portend a reversal. Either way, this type of breakout creates some opportunities for fast-moving mean solar day trades.

Every bit for volume breakouts, you can scan for price breakouts using either the Breakouts module or the Pro Scanner. The Breakouts module allows you to quickly spot stocks that are crossing above or below a simple moving average or setting new 52-week highs or lows. In that sense, it's a very useful tool for finding the widest possible selection of stocks to follow upward on.

However, the Pro Scanner gives you more nuanced control over looking for specific setups. For example, y'all can await for an intraday bullish breakout higher up the 10-day simple moving boilerplate among stocks that have been trending upwards for a long fourth dimension:

DAY OPEN is less than ANALYTIC Simple Moving Average (Daily, 10)

AND

Terminal is greater than or equal to ANALYTIC Simple Moving Average (Daily, 10)

AND

Uncomplicated Moving Average (Daily, 10) is greater than or equal to ANALYTIC Simple Moving Average (Daily, 50)

AND

Uncomplicated Moving Boilerplate (Daily, fifty) is greater than or equal to ANALYTIC Simple Moving Average (Daily, 200)

Y'all can too combine price breakout filters with book filters. For example, you could await for a surly breakout below a 200-day moving average. To notice stocks that are potentially poised for a reversal, you could pair that browse with a browse for lower-than-boilerplate trading book:

Day OPEN is greater than ANALYTIC Uncomplicated Moving Average (Daily, 200)

AND

LAST is less than or equal to ANALYTIC Elementary Moving Average (Daily, 200)

AND

DAY'South Volume is less than ANALYTIC 10 DAY AVG Volume

In this manner, the Pro Scanner can be extremely useful for spotting intraday price breakouts in the context of your custom trading strategy.

3. Scanning for Extreme Weather condition

Another proficient intraday scan focuses more on extreme weather condition, which can lead to sudden and large swings in a stock'due south price. In that location are numerous technical indicators that could exist used to identify abnormal trading conditions. In this case, we'll use RSI, Bollinger Bands, and volatility.

Relative Force Alphabetize (Daily, 14) is greater than or equal to VALUE 90

AND

LAST is greater than or equal to ANALYTIC Bollinger Bands Upper (Daily, 5)

AND

Mean solar day High is greater than or equal to Twenty-four hour period Depression by 5% AND More

You could likewise use five-minute charts for calculating the RSI and Bollinger Bands in order to observe stocks that are highly unstable at the exact moment of your search. Nonetheless, since these are extreme conditions, they are oftentimes fleeting – in most cases, these conditions won't last for longer than a few candlesticks on a 5-minute chart

4. Looking for VWAP Tests

The volume-weighted average toll is an indicator commonly used by 24-hour interval traders. The very fact that it's unremarkably watched is an advantage, since there will typically be a broad market place reaction among traders in response to a VWAP cross or pullback.

There are a number of strategies you can use to trade around the VWAP, only the first stride in any of these is to observe stocks that are trading close to their VWAP at the moment. You can do that with the Pro Scanner by searching for stocks whose prices are testing the VWAP:

LAST is greater than or equal to ANALYTIC VWAP by 0.1% AND Less

Since the VWAP is constantly irresolute, especially in stocks trading with a lot of volatility, this is a scan y'all'll want to run continuously throughout the trading day. Information technology'south also a practiced thought to pair your VWAP scan with a volume filter, so y'all can home in on stocks that plenty of other twenty-four hours traders are watching besides.

Conclusion

Success as a twenty-four hour period trader depends in large function on being able to place profitable setups in real time. Breakouts, extreme conditions, and tests of key indicators like the VWAP are strong signals of volatility that day traders can act on. By searching for these setups with the Scanz Breakouts module and Pro Scanner, you lot tin can make sure that you're one step ahead of the market throughout each trading mean solar day.

Source: https://scanz.com/4-great-intraday-scans-for-day-traders/

0 Response to "How To Set Up Scanner For Day Trading"

Post a Comment